IBAN number

IBAN stands for International Bank Account Number For United Kingdom

What is an IBAN number?

An IBAN is an internationally agreed format for bank account numbers to facilitate cross border payments. IBANs are used to identify bank accounts across national borders to ensure money gets to the right place.

The IBAN contains key details about the recipient’s bank account to enable automated processing – it’s a crucial part of sending and receiving international payments.

IBAN stands for International Bank Account Number

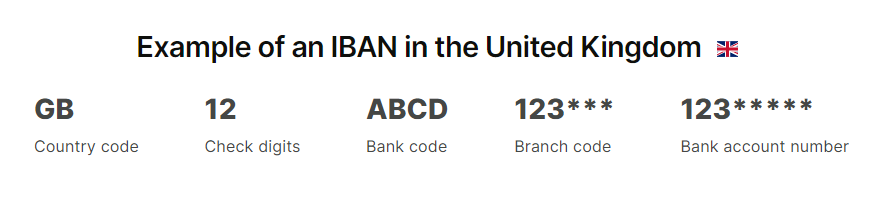

IBAN breakdown

An IBAN is made up of alphabetical and numerical characters, typically up to 34 digits long. Each part gives information to identify the recipient’s bank account.

Country code

2 letter country code e.g. GB for UK, FR for France. Determines routing of payment.

Check digits

2 numerical digits that computer systems use to validate the IBAN number.

Bank code

4 characters to identify the bank where the account is held.

Branch code

More digits to specify the specific branch of the bank for that account.

Account number

The recipient’s unique bank account number.

IBAN example for the UK

Here is an example IBAN for the UK:

Breakdown of UK IBAN

GB – Country code

29 – Check digits

NWBK – Bank identifier code

60161 – Branch code

331926819 – Account number

So the full IBAN would show:

GB29NWBK60161331926819

Where to find your IBAN number

You can usually find your IBAN by:

Online banking

Logging into your online bank account, your IBAN may show in account settings/details.

Bank statements

It will be printed on any bank statements sent to you.

Why it’s important to use the correct IBAN

It’s crucial to use the proper IBAN to ensure:

Avoid sending money to wrong account

Using the wrong IBAN risks your payment going to someone else’s account.

Avoid invalid payment fees

If the IBAN format is invalid, the bank may charge you fees and fail to send the payment.

Validating an IBAN number

Remember:

Correct format doesn’t guarantee validity

Just because an IBAN has the right country code and length, doesn’t guarantee it actually exists!

Check with recipient or bank

You should double check the IBAN with the recipient or your bank before sending funds.

IBAN formats by country

Each country follows slightly different IBAN formatting rules. Common examples:

| Country | SEPA | Length | Example |

|---|---|---|---|

| United Kingdom | Yes | 22 | GB29NWBK60161331926819 |

| France | Yes | 27 | FR1420041010050500013M02606 |

| Germany | Yes | 22 | DE89370400440532013000 |

What is the difference between routing numbers, SWIFT codes, BICs, and IBANs?

To send or receive a transfer, either domestically or abroad, a few details are required.

Individual bank accounts are identified by their IBANs, or international bank account numbers. Many European banks issue them, but banks around the globe are beginning to do the same.

When processing wire transfers or domestic ACH payments, routing numbers are useful for identifying banks. However, just within the US. For example, you don’t need one to pay your friend in France.

Similar to routing numbers, SWIFT codes are used to identify banks and other financial institutions. For foreign payments only this once. They go by the name BIC codes occasionally. Check Swift Code of United Kingdom

Conclusion

An IBAN facilitates international bank transfers by encoding key account details in a standardized way. Using the correct IBAN code ensures your payment reaches the intended recipient – avoiding errors and unnecessary fees.

Every country follows IBAN formatting tailored to their banking system. You should check you have the right IBAN for a recipient before initiating any payment.